Can I get a payday loan if I am on Social Security? . Best Loans in Florida. . Perhaps searching can help. Search for: Apply for a Loan. Enter your ZIP code below to view lenders with cheap loan rates. Secured with SHA-256 Encryption. Loans.org is a unit of 360 Quote LLC providing thousands of consumers with outstanding loan information and .Skip to content. Iris Health Clinic. 262-420-9088 [email protected] questions regarding the use of this website, or the DPT database, should be directed to Veritec Solutions, LLC at 1-877-FLA-DPP1 (1-877-352-3771).After would be the guidelines associated with pay day loans in Florida: A main database is employed for tracking all payday advances in america. a elegance amount of 60 times is allocated in Florida for people who cannot spend the loans on time. Through this era, borrowers must opt for credit counsepng to make certain outstanding dues are cleared.

This page summarizes state statutes regarding payday lending or deferred presentment, which features single-payment, short-term loans based on personal checks held for future deposit or on electronic access to personal checking accounts. Thirty-seven states have specific statutes that allow for payday lending.A borrower may only have one outstanding loan at any time. This is tracked through a statewide database of all loans taken out. The maximum fee is 10 percent of the amount borrowed plus a $5.00 verification fee. The loan term cannot exceed 31 days or be less than 7 days. Certain contract terms that limit a borrower’s rights are prohibited.Florida loan database that is payday. An interest rate limit is imposed on cash advance borrowings within Florida. Dec 16 2020 0 After would be the laws and regulations associated with payday advances in Florida: A main database is employed for monitoring all payday advances in america. a elegance amount of 60 times is allocated in Florida for .

Welcome to the State of Florida Check Cashing Database: This is the Production site! The website is available for all functionality. Call 1-844-FLCCDBS (1-844-352-2327) for assistance. This website is intended for official use. Only licensed check cashers may log in. See the help section for more information.Florida loan database that is payday. After would be the guidelines associated with payday advances in Florida: – Loan ceiling: $500 – range simultaneous loans: One, with a time period of a day for cool down. – Loan term: minimal 1 week. Optimum 31 times. – No rollovers. – 10% for the loan will probably.Under Florida law, payday loans cannot be made in any amount greater than $500. Additionally, payday lenders may not charge fees that exceed 10 percent of the currency or payment instrument provided.

To get the necessary Florida Payday advance up to $1,000 apply online now in a few simple steps. Instant decision from direct lenders is guaranteed. Approval even to bad credit borrowers. Only the best legit direct lenders of Florida.After will be the regulations associated with payday advances in Florida: A main database is employed for monitoring all payday advances in the united states. a elegance amount of 60 times is allocated in Florida if you cannot pay the loans on time. Through this era, borrowers must opt for credit counsepng to make sure outstanding dues are cleared.Anyone is free to apply for a loan. The process is quick and simple, and all you need are a few pieces of information to get the loan application started. Refer to the guidelines below.

This first data point provides detailed analysis of consumers’ use of payday loans with a focus on loan sequences, the series of loans borrowers often take out following a new loan.Florida Payday Loans Online. Study the eligibility criteria and basic information about Online Payday Loans in Florida. Make sure you qualify and apply online now to get same day funding. Get hassle free loan within 5 minutes. Completely Online For all credit types Instant decision .Find a loan in Florida Compare loan rates and apply How much would you like to borrow? Compare Offers Compare Loans in Florida Borrow $1,000 for a period of 6 Months. Edit Search recommended Chosen 74,788 times Loan amount $1,000 APR: 5.99% – 35.99% Total Payment $1,017.54 Monthly payback $169.59 for 6 months 3.

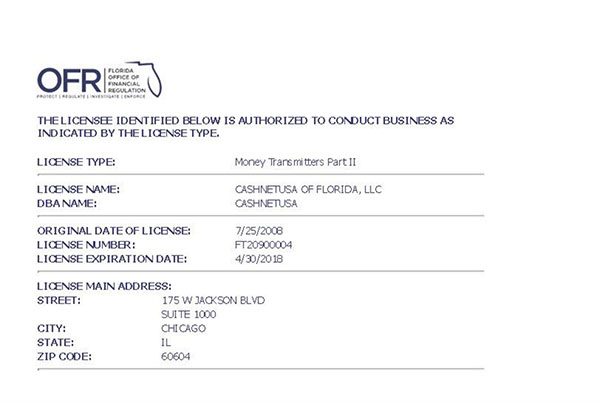

2Typically, the state regulator contracts with the database provider to run the database, and the database provider charges licensees directly on a per loan basis. According to Veritec, the average fee is currently $0.89 and the average charge is $0.81. The difference is that Florida, Kentucky, Oklahoma, and Washington take a portion of the fee.Florida loan database that is payday. An interest rate limit is imposed on pay day loan borrowings within Florida. After will be the laws and regulations associated with payday advances in Florida: A main database is useful for monitoring all pay day loans in america. an elegance amount of 60 times is allocated in Florida for individuals who .

Fees. $5 verification fee per loan, plus $10 per $100 borrowed. Actual loan terms may vary based on applicant’s qualifications. Your loan will be due on your next payday that falls between 8 to 31 days away. If your pay dates fall outside of this range, your loan will be due in 13 days. If you are paid by paper check, we will give you a grace .If a State report include s raw data, the extended payment plan per-loan usage rate is calculated by dividing the number of extended payment plans in the State’s reporting period (typically for a year) by the total number of payday loans for the same period.